The Other Side of the Sunset

Admittedly it’s taken us longer than it should have, but here’s the story behind Fruitful and how we raised over £500,000 of venture funding, built and shipped a marketplace that attracted £1.8million of lending, captured the minds of recognised experts in the field as well as pitching some of the world’s leading venture capital firms, all before running — quite quicky — into a brick wall.

We spent 10 months building product...

We ran in to a trademark battle, so we went through two changes to our brand name.

We settled on Fruitful and drew it out on the beach just to make sure.

We worked all hours under the sun and probably contributed a fair bit in helping Pact Coffee secure their series A.

And then it was time to ship.

It was a dark and cold December’s evening in Liverpool 2014 when we shipped our minimum marketable product.

Yes you’re right, ‘marketable’ sounds a bit McKinsey, but that was our north star, not viability. First impressions count and if you don’t win the hearts and minds of your customers on your first run, it’s more than difficult to attract them back for a second try.

Our product was a marketplace where retail investors — people like you and I — with £250 or more could lend their money directly to businesses that wanted to take out a mortgage on a property, such as an office or a warehouse.

There was big upside for both customers of the marketplace:

- Retail investors — could earn a healthy 6% return on their investments and all the money they lent was secured against the properties.

- Businesses — could secure competitive mortgage rates and better availability than the banks offered.

We thought the best way to get started was to onboard the retail investors first. Once there was enough funds invested, we’d begin offering mortgages.

To get the company started, Luke had crowdfunded the initial £140,000 of venture investment in record time (2.5 days) on Crowdcube. The press that came along with this brought the idea to the attention of 1000s of people — just over 600 of which signed-up for early access.

We decided to soft-launch the product invite-only so that we could manage the flow of investments on to the marketplace easier, not to mention catching any potential problems before they hit a bigger audience.

There was a mixture of excitement and stomach tickling nervousness on the night we were ready to ship. Finance is one of those things you want to get right — people care about their hard earned $. We thought we should invite a few friends and family onboard to kick the tires first.

My good friend Paul Furley pointed out that we referred to KYC during the onboarding process and he asked a great question: “what is KYC?” — we needed to spell that out.

Another friend Chris Ward was a heavy user of peer-to-peer lenders, so I was eager to hear his thoughts. He emailed within a few minutes of receiving his invite saying he thought it was the smoothest onboarding process he’d seen for a finance product.

💪🏼

Later that night, Luke’s partner Gemma pointed out that the user interface looked a bit clunky on her iPad mini. We got the duct tape out and tidied up our responsive breakpoints.

We rolled-out the updates.

The following day, we would take a deep breath and onboard the first 100 out of the 600 that signed up through our marketing website.

Fast Forward 2 Months

We had over £500,000 invested on the marketplace. Things were looking great and we were feeling even better.

The press wrote lovely things about the product we worked so hard to bring to life.

Recognised experts in the field of finance praised the product and the vision that we were working towards.

More importantly, our customers were happy customers. We had encouraging feedback coming in almost every day.

It was the most inspiring thing to wake up to in morning.

Something Ventured…

With a whole bunch of graphs that went up and to the right, it wasn’t long before we heard from venture capital (VC) firms looking to invest.

Luke and I took calls with analysts and we pitched Fruitful’s series A investment before being passed-on to the partners.

Our first meeting was with the London office of Accel Partners — the firm that made the biggest VC return in history with their investment in Facebook. They’d also put money down on other companies we admire from afar such as Dropbox, Etsy and Slack.

A few days after we flew out to the San Francisco Bay Area.

We took partner meetings with Kholsa Ventures (investors in Stripe & Vox Media), Menlo Ventures (investors in Uber & Tumblr), the unstoppable Google Ventures and True Ventures (investors in Fitbit, Blue Bottle Coffee & NPM).

We were our own harshest critics but we felt the meetings went well and we were confident we’d raise our Series A.

We even went to the effort of making a list of our favourite VCs we’d like to work with most.

We were planning how we’d spend our millions even though we only had a lottery ticket.

Eager to hear back, we were checking Luke’s emails every five minutes. He checked one last time before our flight departed SFO for LDN.

SFO > LHR

After a lengthy 14 hour flight, we touched down in London. Luke flicked his emails open. Bingo — we had a few responses from some of the VCs we met.

“They said they’re interested in the problem we’re trying to solve, like the team, but they can’t get comfortable with our CAC — so they’re gonna pass for now.”

“CAC? what’s CAC on a Tuesday morning?” I asked; at which point I could see Luke searching Google for ‘CAC startups venture capital’.

[C]ustomer [A]cquisition [C]ost

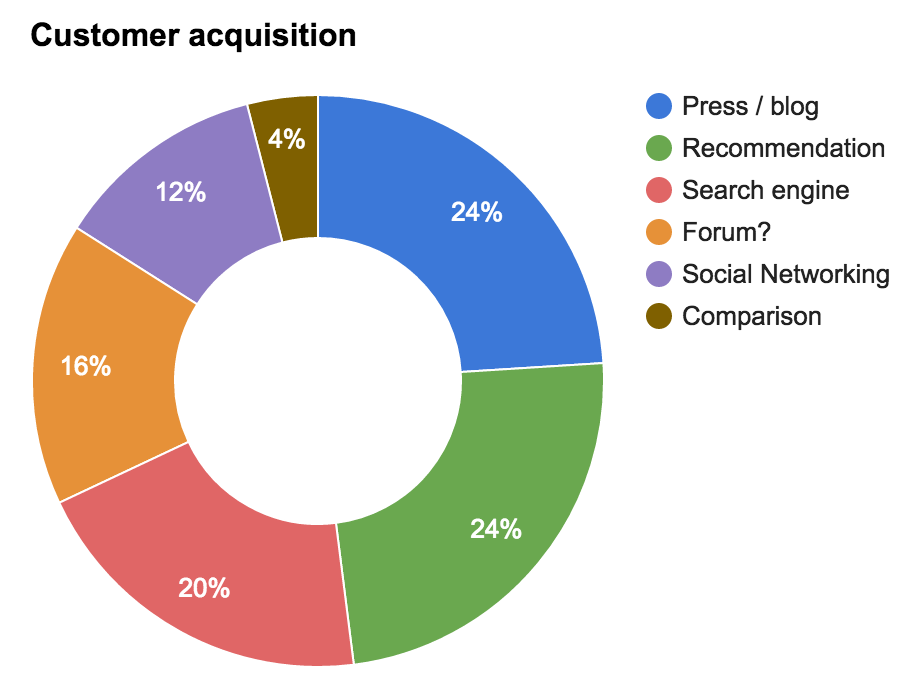

This was our slap in the face introduction to startup economics. We’ll unpack more about this in an upcoming post, but in short, VCs took the position that we’d spend too much money acquiring enough retail investors to scale Fruitful into a big enough business.

Later that week, we’d heard back from all of the other firms — they all landed on the same conclusion.

This was a huge blow.

But even when we looked at the data that we had accumulated in our soft-launch, we could see that in the long run, we were going to burn through a lot of money on both sides of Fruitful’s marketplace:

- Acquiring enough retail investors to lend their money [and]

- Acquiring the businesses to take mortgages out

Not only that, but there were more broader concerns around the size of the commercial mortgage market and whether we’d run out of headroom to grow quite quickly.

We’d spent so much of our energy focusing on the lending product for retail investors that we’d missed some important considerations on our business model.

Kings of a Sinking Ship

All the while, we were still onboarding 100s of new customers each month. Growth through customer recommendation was around 24% (and growing), we were up to £1.8million in marketplace investments, we’d lent our first batch of mortgages and customers were over the moon with what we had brought to market.

When we googled Fruitful, there were countless forum threads where our customers were being great ambassadors, saying how impressed they were with the product and the service we offered.

A Fruitful’s mortgage borrower sent us some really good cake.

This was a weird and a mixed up place for us as founders. On one hand we had shipped a product that customers were elated with—on the other—we had a business model that was ultimately broken.

Ross from Friends Yells…

We knew it was time to get back to the drawing board and figure out a way forward. So we made a pivot.

As part of the pivot we took the painful and nerve-racking decision to wind down Fruitful 1.0.

We drafted a letter to our customers that explained what we set out to do, the obstacles we ran in to and how we were going to wind down Fruitful 1.0 in the most direct, candid and human way possible.

We genuinely felt a deep appreciation for the faith our early adopters invested in us and we wanted this to be reflected when we explained that we were going to wind down the product they’d fallen in love with.

There was nail bitting apprehension on the day we were ready to send the email. We had no idea how this was going to be received.

We had terms that made this a legally sound move for us to make, but for all we knew, customers could have taken the news badly. They could have done anything on social media to ruine the Fruitful brand. Some could have challenged us legally anyway.

We hit send.

The message sent to just over a 1000 customers.

To our amazement, within the first five minutes we heard from a few customers:

- One congratulated us on the work we’d done. She said she felt honoured to be one of our early adopters and she was looking forward to the new product we were bringing to market.

- Another chap echo’d this and mentioned that he’d been working in securities at an investment bank for the last 20 years. He was considering a career change so if we needed any help, he was more than happy for us to reach out. Of course I googled his name, landed on a LinkedIn page, only to find he was a Senior Vice President for, lets say, a very respectable global investment bank.

- We had another guy asking if he could leave his money with us.

- Another chap explained that he was sad to see Fruitful go as we were head and shoulders above a bunch of others marketplace lenders he tried investing on.

For the rest of that week we saw more and more messages in a similar vein, leaving us feeling a mixture of relief; that the letter was well received and slighty sad and empty; knowing that we’d put down the baton on a product that we’d worked so hard to bring to life, that clearly won the hearts and minds of our customers.

It’s been a bumpy ride but since the start of the year, we’ve made some big steps forward on our new vision.

We’ve since hired Mark Selby, the former Chief Operations Officer of Santander, Virgin Money and the chap responsible for the Sainsbury’s Local format stores to join us as Chief Operations Officer.

We’ve assembled a strong team of advisors including:

- Colin Walsh the former CEO of American Express, Managing Director at Lloyds Banking Group here in the UK and board member at VISA.

- Krunal Jashapara former VP of Capital Markets at UBS—where he was responsible for more than £20billion of mortgage investments—as advisors to Fruitful.

We’ve been working really hard on building out our new product and we’ll be sharing more about this over the Summer.

Take From This What You Will

Last week we made a pact; we would put some work into unpacking what worked well with Fruitful 1.0, what really didn’t work well and what we might have done differently given the battle scars we have now.

Some of the topics we’ll cover include:

- Building a marketplace — where to start

- Mind the CAC (Customer Acquisition Costs)

- Using Intercom to ramp-up customer engagement

- How to wind-down a fintech business

- Assembling a strong team

Beyond this, we hope to make the Ingredients blog a useful collection of notes, insights and ideas fresh off of the workbenches at Fruitful, where we’ll address topics such as technology, design, finance and keeping your sanity when building a company.

We hope you’ll hit follow and join us for the journey.

Stay tuned,

Tom Darlow, Luke Barnes & Paul Bennett-Freeman

Always read the Ingredients. Have the occasional note, insight or idea on topics such as design, software development, hiring, finance and keeping your sanity when building a company/ delivered fresh, right to your inbox ➙